October 1, 2016

How efficient is your landscape company?

BY MARK BRADLEY

Another day, another job supposed to start — but your crews are standing there without the right tools or materials. Someone jumps in the truck to go back to the shop to get a tool. The crews left on site start another task, but they are not working in the right order. Materials get moved and moved again to work around piles. We have to work around (or on top of!) work that’s almost finished.

Another day, another job supposed to start — but your crews are standing there without the right tools or materials. Someone jumps in the truck to go back to the shop to get a tool. The crews left on site start another task, but they are not working in the right order. Materials get moved and moved again to work around piles. We have to work around (or on top of!) work that’s almost finished.The job was supposed to be finished in five days, but it’s day seven and it might still be another day before it’s finished. Normal, right? Or is it? Just how big a problem are these mistakes? What’s it costing us?

Every contractor reading this knows mistakes cost money — but it’s hard to put a finger on just how much. Lucky for us, we can actually come up with an accurate estimate of the cost of inefficiency using a simple company metric — our efficiency rating — to measure productivity. This rating compares actual sales to potential sales. It compares “What did we earn?” vs. “What should we have earned?”

Here’s how to calculate your company’s efficiency:

Step 1: Calculate potential earnings at 100 per cent efficiency

Calculating what you should have earned isn’t just a guess. With a few basic numbers, you can calculate your potential.

- Total payroll hours for field staff (only field workers, no office staff)

- Total job expenses (materials, subcontractors, other and equipment, assuming you don’t count equipment as overhead)

- And your usual (or average) markups for pricing

Let’s use a sample set of numbers for an average landscape company:

Annual payroll hours for field staff - 15,000 hours

Annual equipment expenses - $120,000

Annual material expenses - $250,000

Annual subcontractor expenses - $25,000

Annual rentals and other - $5,000

All these expenses listed above are job expenses. If you’ve estimated correctly and charged your estimates correctly, you should be able to recover almost all of these expenses from your paying customers.

Start with labour, and remember to only include hours for your field staff. The company above has 15,000 field labour hours. If their average charge-out rate was $50/hour, then they had $750,000 in potential sales from labour.

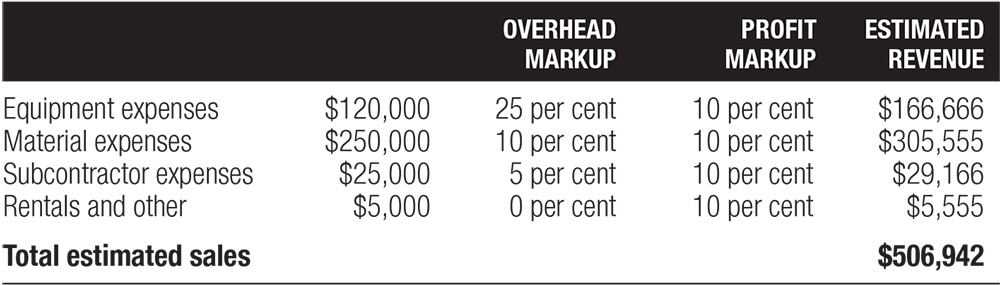

Next, calculate how much revenue you should have earned from your other job-related expenses. Apply your pricing system to your job costs to estimate what you should have earned from those costs. For the example below I used a multiple overhead recovery system to add overhead and added a 10 per cent profit to estimate what we should have earned based on these costs.

To calculate estimated revenue for each cost, we multiply the cost by (1 + the overhead percentage), then divide that subtotal by (1 – the profit percentage). Example: $120,000 x 1.25 (25% overhead markup) = $150,000. $150,000 divided by .9 (which comes from 1 - .10 (profit of 10 per cent) to get estimated revenue of $166,666. Confused? Watch this video: http://bit.do/profitmargin. It will fix an extremely common pricing mistake.

These two numbers tell us exactly what our sales potential was: $750,000 (sales from labour) + $506,942 (sales from other job costs) = $1,256,942. If you recovered all your job costs from your paying customers, you should have earned a little over $1.25 million in revenue this year.

Step 2: Calculate your actual efficiency

Now it’s simple to calculate our actual efficiency. Simply take your actual sales and divide them by your potential sales to calculate the percentage of potential revenue you are actually realizing.If the company we’re looking at had actual sales of $990K, then its efficiency rating looks like this:

$990,000 (actual sales) divided by

$1,256,942 (potential sales) = 78 per cent.

$1,256,942 (potential sales) = 78 per cent.

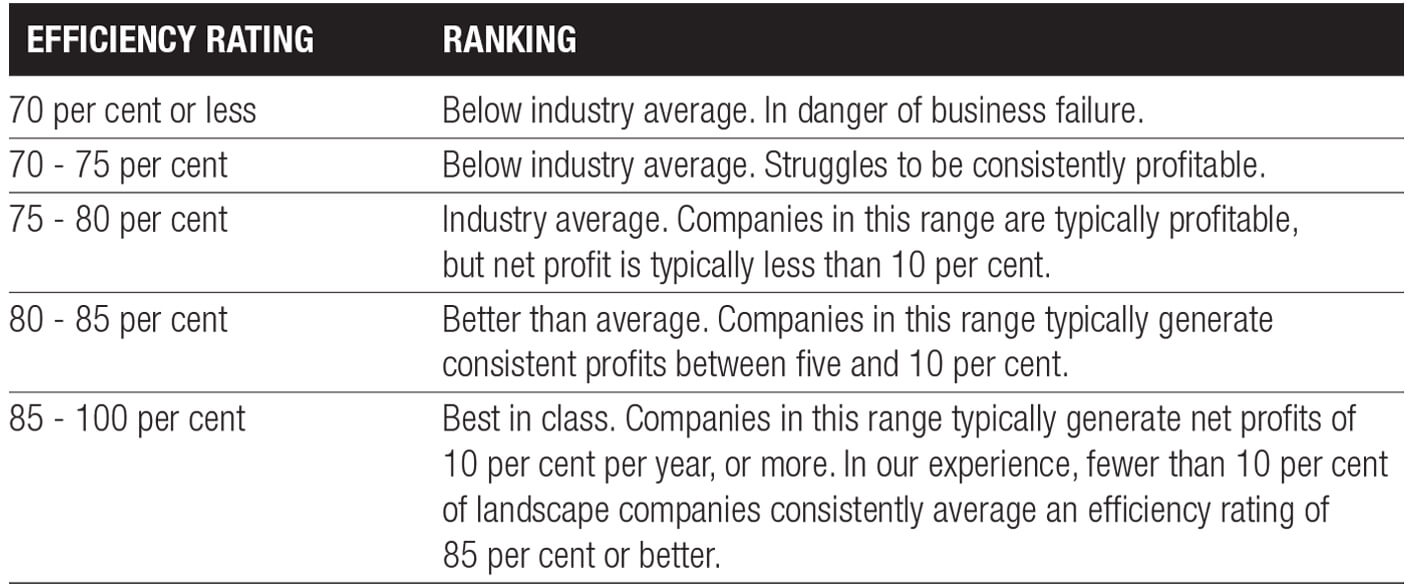

This sample company earns 78 per cent of the revenue it should be earning in a perfect world. That doesn’t seem too bad — it’s very close to 80 per cent, but think about how much money went unrecovered. This company has lost $266,000 — or 27 per cent of its total sales — to mistakes and unrecovered costs. Ouch.

The light at the end of the tunnel is that a company missing $266K in revenue has all kinds of opportunity to improve profits. They are already paying the costs; we’ve counted the labour, material costs, etc. They just need to better convert those costs into earned revenue by reducing mistakes, improving estimates, improving on-time performance and more.

To help benchmark yourself against industry averages, see the chart above for how landscape companies typically stack up when it comes to efficiency.

The bottom line: Quantify your company’s efficiency to get a handle on opportunities for improved profits.

Mark Bradley is the president of TBG Landscape and the Landscape Management Network, based in Ontario.