January 3, 2011

A century of protection

BY LEE ANN KNUDSENWorkers compensation insurance provides important protections,

and has gone beyond that mandate to promote safety

Every day across Canada, workers go on the job, worrying about everything under the sun except work-related injuries. Employers, by and large, are free to address all kinds of challenges, without fear that a worker’s on-the-job injury could put them out of business.

Workers’ compensation insurance has worked so well, for so long, that it only seems to come to mind when the premiums are due. The idea originated in the late 1800s, when German chancellor Otto Von Bismarck introduced a compulsory, state-run accident compensation system. The idea had its Canadian beginnings in 1910, when Justice William Meredith was appointed to a Royal Commission studying workers’ compensation.

His 1913 Meredith Report outlined a trade-off in which workers relinquish their right to sue, in exchange for compensation benefits. Meredith advocated for no-fault insurance, collective liability and exclusive jurisdiction. These cornerstones, along with security of payments and independent, non-political governing boards, have survived to today’s business environment.

“We are fully funded,” says Warren Preece of the Workers’ Compensation Board of Manitoba; typically, employer premiums, not tax money, finance the operations of Canada’s provincial workplace insurance boards. Industries are typically assigned rate codes based on accident history, and enjoy premium reductions industry-wide if safety performance improves. Several employment sectors in Manitoba have formed safety associations to collect fees within their rates codes, to fund safety training programs.

Further, individual companies committed to safety may take advantage of programs offered in most provinces, generally called “experience rating,” that can adjust rates based on their safety records. Just under 3,000 Ontario green-industry employers, for example, get percentage points off their rates through the Merit Adjusted Program, according to Christine Arnott of the province’s Workplace Safety and Insurance Board (WSIB).

Of course, experience rating can cut two ways, and provincial programs also rate employers up if their performance is poor.

Creative prevention

Two Ontario programs, partnerships between the WSIB and industry, go beyond insurance coverage to proactively promote safety for workers. The WSIB launched the Safety Groups Program as a pilot in 2000, with approximately 400 employer members. Landscape Ontario has sponsored Safety Groups since 2001. The idea was launched to provide an incentive for members to invest in and implement effective health and safety and return-to-work programs in their workplaces.

In the program, firms volunteer to form a group with a collective purpose: to learn from each other’s experience in implementing injury and illness prevention programs. Participants select five safety elements they will implement or improve upon, from a list provided by the WSIB. Representatives from the firms attend meetings, share ideas and pool resources, learning from each other how to put the initiatives into place. Success is rewarded with premium rebates — the amount depends on the degree of success the Safety Group has in incorporating and improving its chosen prevention programs.

Safety Group participation has grown significantly. In 2010, there are approximately 3,700 employer members representing more than 6,000 workplaces across all Ontario sectors.

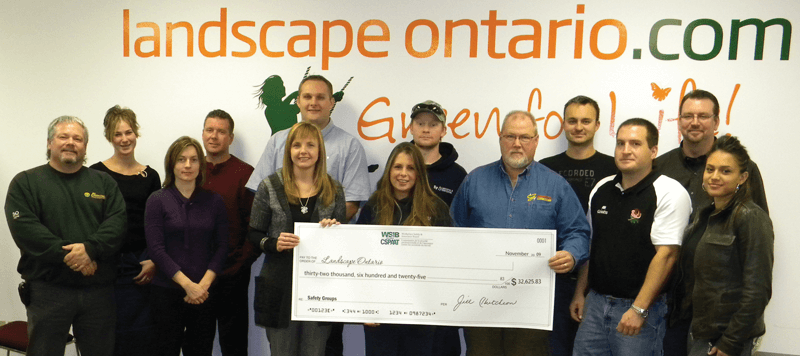

This Ontario Safety Group split a $32,000 rebate cheque — tangible return for its cooperate efforts to promote safety.

Endorsed by industry

While the benefits of Safety Group participation can be measured in real dollars, do they actually improve safety on-the-job? “Absolutely,” says Angela Good, safety committee head at BP Landscaping, Caledon, Ont. “Last year we had 24 injuries, and this year, after implementing the new programs, we had only four. It was a phenomenal turnaround.” The groups helped BP implement intensive training programs, backed up with manuals for all procedures. “The huge hazard manual is our bible,” Good says. BP actually shares detailed, specific safety data with all employees, and credits that policy as part of its success in improving safety culture.

Another forward-thinking Ontario initiative is the Safe Communities Incentive Program, offering free training opportunities. Landscape Ontario has partnered with WSIB since 2003, to help horticulture industry members learn about their compliance roles and responsibilities according to the Occupational Health and Safety Act, as well as how to manage their health and safety risks to prevent injuries, illnesses and interruptions to their businesses. Approximately 350 firms have benefited from participation.

SCIP and Safety Groups have improved overall rates in the Ontario landscape sector, from about 9.8 per cent, to the current four per cent. This has resulted in annual savings of over $15-million for the province’s landscape industry, about equal to its current rate payments.

So while workplace insurance is yet another required cost of doing business, it is in its second century of serving Canada’s businesses and employees well, and can take pride in actually preventing accidents.